There are indications Nigerians will be able to leverage eNaira for investment purposes in the near future even though the central bank digital currency (CBDC) was created solely for financial transactions.

At the sensitisation and activation session with Oshodi market leaders, the Central Bank of Nigeria (CBN) team leader, Yusuf Jelil, said the regulator has given financial technology (fintech) firms to explore the possibility of creating investment products around the digital currency, which Nigerians could key into for wealth creation.

Jelil, however, said such products would be approved by the apex bank before they are rolled out. He did not give details about the likely investment opportunities but said the CBN would wait on the techies to come up with their initiatives.

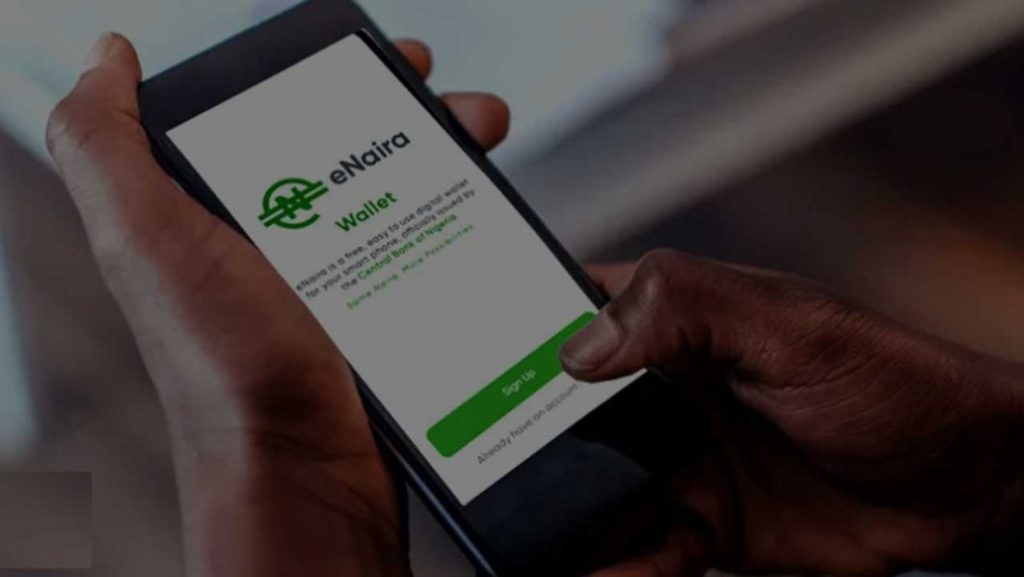

He spoke on some of the ongoing plans to make eNaira accessible to average Nigerians, saying the app is awaiting an update that will enable users to transfer money from their bank accounts to wallets with the use of unstructured supplementary service data (USSD).

The regulator had earlier disclosed that USSD was part of the grand plan to drive the adoption in rural communities and areas where poor Internet connectivity.

Also speaking at yesterday’s event, the Lagos Branch Controller, Barry Toyor, promised that the bank would protect users of the digital currency and ensure that nobody loses a kobo from their wallets. He said the value involved in a transaction is received instantly, giving it an edge over other platforms.

He urged traders to see eNaira as their “reliable and secured” media for sending and receiving money, including cross-border financial transactions.

According to him, Oshodi was chosen for the partnership owing to its centrality and diversity “meaning that we can reach other markets and individuals of different backgrounds across the country through this effort”.

Obinna Umeh, one of the market leaders, is hopeful eNaira will reduce disputes over failed transactions, which he said the “trader associations spend much of their time settling. And if we get it right in Oshodi, other markets will follow this is central to other markets in Lagos.”

The CBN team, market leaders and Bizi Mobile, a vendor to CBN on eNaira, discussed the modality of signing and enlisting traders as agents under the vendor scheme of the CBDC rollout programme. This, Dr. Aminu Bizi, the chief executive of Bizi Mobile, said would speak up about the adoption rate.

SOurce: Guardian.ng