By Abdulrahman Aliagan| Time Nigeria Magazine

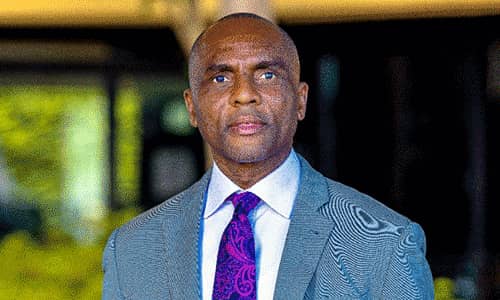

In a striking development that underscores the global reach of anti-corruption enforcement, a United States District Court has ordered the forfeiture of a property in California linked to Paulinus Okoronkwo, a former General Manager at the Nigerian National Petroleum Corporation (NNPC), now NNPC Limited.

The court ruling, delivered in early October, followed Okoronkwo’s conviction in September for transactional money laundering, tax evasion, and obstruction of justice. Prosecutors argued that the property—located at 25340 Twin Oaks Place, Valencia, California—was purchased with funds derived from a $2.1 million bribe paid to Okoronkwo by Addax Petroleum, a Swiss subsidiary of China’s state-owned oil giant, Sinopec.

The $2.1 Million Bribe Scheme

According to court documents, Okoronkwo, while serving as General Manager in NNPC’s upstream division, abused his official position by receiving a $2.1 million “consultancy payment” from Addax Petroleum in October 2015. The payment, prosecutors revealed, was wired to his law firm’s trust account in Los Angeles under the guise of professional legal fees.

However, evidence presented in court exposed the transaction as a bribe to secure favourable drilling rights in Nigeria. Addax executives allegedly falsified company records, dismissed internal whistleblowers who questioned the transaction, and misled auditors to conceal the illicit payment.

At the time of the transaction, Okoronkwo had already transitioned to private legal practice in Koreatown, Los Angeles, specializing in immigration, family, and personal injury law. Prosecutors said he subsequently used nearly $1 million of the bribe proceeds as a down payment on the Valencia property, while failing to declare the income on his 2015 U.S. tax return.

The Forfeiture Order

The forfeiture, granted by U.S. District Judge John Walter on October 3, 2025, marks a significant milestone in the case. The judge ruled that the U.S. government successfully established a “requisite nexus” between the property and the criminal offenses.

“For the reasons set out below, any right, title, and interest of the defendant in the following described property is hereby forfeited to the United States,” the court order reads in part.

The ruling authorizes the U.S. Attorney General, or a designated representative, to seize and dispose of the property under Federal Rule of Criminal Procedure 32.2(b)(3) and 21 U.S.C. § 853.

The forfeited property, identified as Tract Number 45433, Lot 12, with Assessor’s Parcel Number 2826-143-004, will now be subject to liquidation, with the net proceeds remitted to the U.S. government.

Awaiting Sentencing

Judge Walter has scheduled December 1, 2025, for Okoronkwo’s sentencing hearing. Legal analysts anticipate a stiff sentence given the scope of the financial crimes, which combined elements of public sector corruption, international bribery, and financial concealment.

The conviction serves as another reminder of the growing international collaboration in tracking and prosecuting financial crimes involving public officials, particularly those linked to Nigeria’s oil and gas industry.

A Broader Anti-Corruption Message

The Okoronkwo case not only sheds light on persistent governance challenges within Nigeria’s petroleum sector but also reinforces the U.S. government’s stance on cross-border accountability. The ruling demonstrates how illicit gains—no matter where they are stashed—remain vulnerable to asset recovery mechanisms under international law.

As the world awaits the December sentencing, the case stands as a cautionary tale for public officials who seek to exploit their positions for personal enrichment. For Nigeria, it renews the urgent call for transparency, ethical governance, and stronger institutional mechanisms to deter corruption in its most lucrative industry.